We will discuss the current price of Yes Bank shares in this article and Yes Bank Share Price-2024. If we are talking about then , today the Yes Bank shares price is Rs 24.90 The 52-week low is Rs 14.40 and the high is Rs 26.25.

Yes Bank, also known as Yes Bank or Indian Private Sector Bank was founded by Rana Kapoor in 2004. Mumbai is the headquarters of the bank. Yes Bank has gone through many phases throughout its history. Its price has also seen many gains.

This post will provide detailed information on the Yes Bank share price.

Yes Bank Share Price 2024 – 2025 – 2030 – 2035 – 2040 – 2050

Overview

Yes Bank Limited is proud of its impressive network which extends to 331 branches across 200 cities. To strengthen this strong infrastructure, there are over 420 ATMs strategically located across Mumbai and Gurgaon.

This strategic set-up ensures that the Bank’s customers enjoy unparalleled access and convenience, reaffirming its commitment to serve customers efficiently.

Press Release and Investor Presentation on the financial results for the quarter (Q3) and nine months ended December 31, 2023 (Dated 27 Jan 2024)

Banks can provide a variety of services, all tailored to specific needs.

Corporate Banking and Institutional Banks:

Corporate Finance:

Provides comprehensive financial assistance to corporate entities.

Retail banking is a wide range of financial services tailored to the needs of individual consumers, aimed at ensuring their convenience and financial well-being.

You May Also Like: Renewable Energy Shares in India 2024

Investment Banking

The Bank plays an important role in facilitating strategic investments, providing valuable financial advisory services and enhancing its role as a financial partner.

The diverse business areas of Yes Bank Limited demonstrate its commitment to meet a variety of financial needs. This includes small businesses, large corporations, consumers or other entities seeking strategic financial advice.

Yes Bank is among the fastest-growing Indian private-sector banks. It provides a wide range of financial and banking services, including retail banking, corporate banking, wealth management, insurance, and investment banking.

Popular products include loans, savings, and current accounts. Yes Bank offers a range of services including mobile banking, e-banking and loans.

The company continues to focus on NPA recoveries while expanding its business to include global markets and asset management. It is also developing a corporate lending business with a focus on medium-sized businesses.

To expand into new markets, the company is focused on digital initiatives. It also acquires businesses that offer cost-effective services for its customers.

Yes Bank Share Price-2024

| Year | Share Price Target (₹) |

| 2024 | ₹32.90 |

| 2025 | ₹38.50 |

| 2026 | ₹41.13 |

| 2027 | ₹52.50 |

| 2028 | ₹61.70 |

| 2030 | To ₹80.00 |

| 2035 | 190.00 |

| 2040 | 280.00 |

| 2050 | 470.00 |

Yes Bank Share Price-2024

Yes Bank began its own operations as a full service bank in 2004. In its early times, Yes Bank grew and expanded fleetly. Yes Bank shares hit a new high in India. This Bank was among the largest banks in the private sector. The Bank specialized in retail and commercial banking.

anticipated Yes Bank’s shares have been steadily increasing. Yes Bank’s share could reach new heights. Yes Bank’s share price will exceed ₹ 32.90 by 2024.

Yes Bank Share Price Target 2025:

You May Also Like: Wipro Share price target:

| Date | Price (₹) |

| January 2025 | ₹33.22 |

| February 2025 | ₹34.90 |

| March 2025 | ₹35.20 |

| April 2025 | ₹36.20 |

| May 2025 | ₹36.90 |

| June 2025 | ₹37.10 |

| July 2025 | ₹38.20 |

| August 2025 | ₹39.30 |

| September 2025 | ₹40.35 |

| October 2025 | ₹41.40 |

| November 2025 | ₹42.40 |

| December 2025 | ₹43.50 |

The “Yes Bank Share Price Target 2025” is listed at ₹43.50, as specified

Yes Bank Share Price Target 2026:

Yes Bank suffered a setback when Yes Bank experienced financial problems in 2020, which caused a crisis. Reserve Bank of India was forced to intervene to save the Bank.

State Bank of India was in charge of the Bank as part of a rescue plan. Yes Bank was invested by a consortium and RBI temporarily banned withdrawals. After that, Yes Bank began to improve.

Yes Bank share price target Rs 55.13 by 2026 for future growth.

| Date | Price (₹) |

| January 2026 | ₹44.60 |

| February 2026 | ₹45.65 |

| March 2026 | ₹46.50 |

| April 2026 | ₹47.55 |

| May 2026 | ₹48.90 |

| June 2026 | ₹49.80 |

| July 2026 | ₹50.00 |

| August 2026 | ₹51.30 |

| September 2026 | ₹52.95 |

| October 2026 | ₹53.40 |

| November 2026 | ₹54.80 |

| December 2026 | ₹55.13 |

Yes Bank Share Price Target 2027:

Yes Bank is committed for recovery. Yes Bank celebrated Purnima with new investors after the crisis. Reserve Bank of India was of great help to Yes Bank, which allowed it to recover.

Yes Bank Share Price Target Rs 67.50 in 2027 for future growth

| Date | Price (₹) | ||||||||||||

| Jan-27 | ₹56.93 | ||||||||||||

| Feb-27 | ₹57.65 | ||||||||||||

| Mar-27 | ₹58.70 | ||||||||||||

| Apr-27 | ₹59.95 | ||||||||||||

| May-27 | ₹60.70 | ||||||||||||

| Jun-27 | ₹61.80 | ||||||||||||

| Jul-27 | ₹62.00 | ||||||||||||

| Aug-27 | ₹63.30 | ||||||||||||

| Sep-27 | ₹64.35 | ||||||||||||

| Oct-27 | ₹65.40 | ||||||||||||

| Nov-27 | ₹66.40 | ||||||||||||

| Dec-27 | ₹67.50 | ||||||||||||

| The “Yes Bank Share Price Target 2027” at ₹67.50 | |||||||||||||

Yes Bank Share Price Target 2028:

Yes Bank has come out of its previous situation and is now in a better position. Then Yes Bank has shown good growth. Yes Bank showed continuous resistance over the past few months/days. We have seen a 400 percent growth.

Yes Bank share price target Rs 69.70 by 2028 for future growth.

A positive economic climate and the company’s focus on NPA recovery in the coming few months could lead to increased better profitability in future.

It also has many growth opportunities via acquisitions and partnerships. They could help increase revenue and diversify the business.

| Date | Price (₹) |

| Jan-28 | ₹68.90 |

| Feb-28 | ₹69.50 |

| Mar-28 | ₹70.80 |

| Apr-28 | ₹71.60 |

| May-28 | ₹72.65 |

| Jun-28 | ₹73.60 |

| Jul-28 | ₹74.44 |

| Aug-28 | ₹75.50 |

| Sep-28 | ₹76.80 |

| Oct-28 | ₹77.30 |

| Nov-28 | ₹78.55 |

| Dec-28 | ₹69.70 |

The “Yes Bank Share Price Target 2028″ at ₹69.70

Yes Bank Share Price Target 2029:

Yes Bank share price target Rs 81.70 by 2029 for future growth.

| Date | Price (₹) | ||||||||||

| Jan-27 | ₹70.50 | ||||||||||

| Feb-27 | ₹71.95 | ||||||||||

| Mar-27 | ₹72.65 | ||||||||||

| Apr-27 | ₹73.50 | ||||||||||

| May-27 | ₹74.10 | ||||||||||

| Jun-27 | ₹75.90 | ||||||||||

| Jul-27 | ₹76.04 | ||||||||||

| Aug-27 | ₹77.10 | ||||||||||

| Sep-27 | ₹78.30 | ||||||||||

| Oct-27 | ₹79.20 | ||||||||||

| Nov-27 | ₹80.40 | ||||||||||

| Dec-27 | ₹81.70 | ||||||||||

| The “Yes Bank Share Price Target 2029” at ₹81.70 | |||||||||||

Yes Bank Share Price Target 2030:

Yes Bank has been working hard to recover and achieve stability and growth. This is why the share price of Yes Bank has grown rapidly. Target will surpass Rs 80 by 2030, and shift to the long-term.

Yes Bank share price target may be Rs 93.00 by 2030.

| Date | Price (₹) |

| January 2030 | ₹82.70 |

| February 2030 | ₹83.20 |

| March 2030 | ₹84.40 |

| April 2030 | ₹85.60 |

| May 2030 | ₹86.65 |

| June 2030 | ₹87.80 |

| July 2030 | ₹88.00 |

| August 2030 | ₹89.30 |

| September 2030 | ₹90.60 |

| October 2030 | ₹91.70 |

| November 2030 | ₹92.90 |

| December 2030 | ₹93.00 |

Shareholding in Yes Bank

Following are the shareholdings of Yes Bank:

Promoters: The State Bank of India is the largest shareholder in Yes Bank with a 48.21 percent share.

Foreign Institutional Investors: Foreign Institutional Investors own a large stake in Yes Bank. They account for 27% of the total ownership.

Public The rest of the Yes Bank shareholdings are held by individuals and other institutional investors.

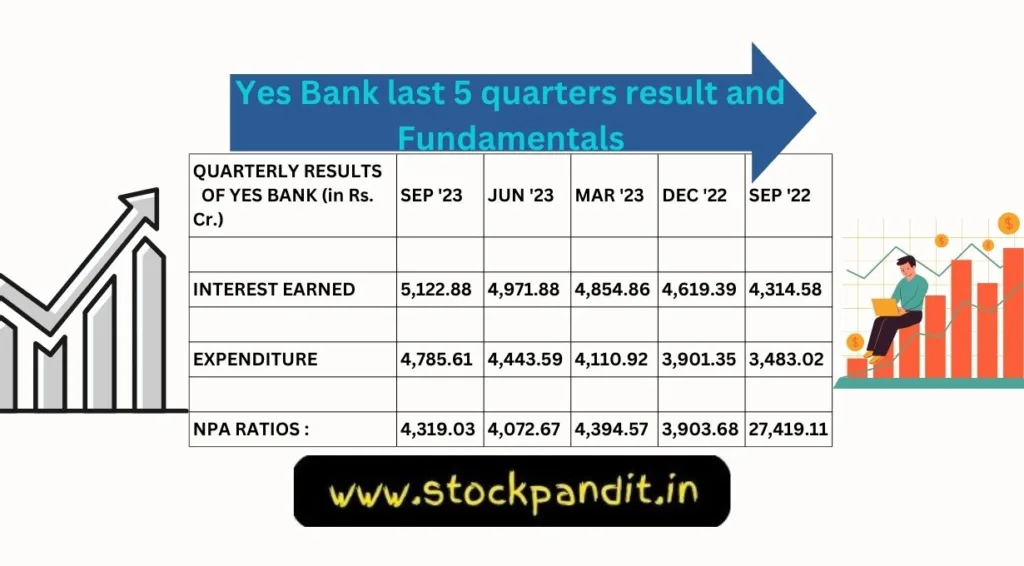

Yes Bank last 5 quarters result and Fundamentals

Future of Yes Bank Share

Yes Bank has faced many challenges and difficulties in the past years. These include the pressure on its NPA and loans, issues with the government and a change of management.

In addition despite these challenges, the Bank is striving to improve its financial performance and operational performance. The Bank has reported an improvement in its net profits for the period 2021-2022.

You May Also Like: Best Semiconductor Stocks to Buy in 2024

The conclusion of the article is:

We also discussed the growth and future prospects of Yes Bank in detail.

You should be able to make a wise investment decision based on the information provided to you.

Yes Bank: is it a multibagger?

Right now Indeed, Bank is a multibagger stock since it has shown us encouraging indicators of future development.

The Brickwork ratings’ upgrading of the Tier 1 subordinated perpetual bonds, Yes Bank’s stock increased by more than 10%. The BWR D rating was replaced with BWR BB+/Stable.

Is Yes Bank a long-term viable option?

One of the top private banks in India, YES Bank places a high priority on expansion and profitability. Better asset quality and more deposits are boosting its profitability. Also, the bank’s NPA ratio is less than it was a year ago.

Can I purchase shares in Yes Bank?

How do I purchase a share of Yes Bank? Through a brokerage company, you can purchase shares of Yes Bank. You can make orders to purchase Yes Bank shares through ICICIdirect, a registered broker.

Do dividends get paid by Yes Bank?

Ratios connected to dividends at Yes Bank Ltd.

Payout of dividends each year: ₹4.70; current dividend yield is 19.54%.

Is the share of Yes Bank safe?

The YES Bank stock increased at 16 percent in a year but decreased by 8 percent in 2023. The stock has increased 27.61 percent in the last six months.

The bank’s market capitalization during Tuesday’s trading session was Rs 57,200 crore. With a one-year beta of 0.4, YES Bank shows little volatility throughout that time.

Disclaimer

Dear Reader, we would like to inform you that we are not authorized by SEBI (Securities and Exchange Board of India). This site contains information and education only. It should not be construed as financial advice or stock recommendation.

The share price forecasts are also only for reference. Price predictions are only valid when the market is showing positive signs. This study will not take into account any uncertainty regarding the future of the company or the state of the current market. This site is only for informational purposes.

We cannot be held responsible for any financial losses you may incur as a result of the information provided. We provide you with timely updates on the stock market, financial products and other topics to help make better investments. Make sure you do your research before making any investments.