The fluctuations in stock prices over time form the foundation of our overall view of the stock market. A stock’s last traded price, or LTP, is a term used to describe trades traded in the stock market. Clarified here with the example, What Is LTP In Stock Market-2024.

Its reflects the price at which the stock was just bought or sold. Since the LTP of a stock keeps changing during buying/selling, the meaning of LTP can be understood from its

Formula to Calculated LTP l Before LTP What Is The Price Called In Stock Market

LTP is defined as a commodity whose price is determined by stock traders (Consumers); as both sellers and buyers are stock market traders, they are regarded as consumers.

When a trader wants to sell their shares, they will put in a sell order for the desired price, taking into account the share’s performance and current price.

The transaction is finalized and the price at which the stock was sold becomes the last trading price if this sell order is met by a purchase order from another dealer.

You May Also Like: What Is Expiry Date In Indian Stock Market

Definition of LTP in Stock Market l What Is The Use Of LTP In Stock Market

A stock’s LTP is the final price at which a trade is made. Last Traded Price is LTP in its entirety. It is a starting price that is determined by the mood of the market. It varies in response to shifts in the supply and demand for stocks.

LTP assists buyers and sellers in determining the appropriate price range for a trade as well as in finding pertinent stock values. The nature of this price is unstable.

When a company’s stocks are traded in high volumes, the price comes closer to its actual value. On Shree Varahi, the NSE, and the BSE, you may check the LTP of any stock.

The Last Trading Price’s (LTP) significance

- Recognizing historical pricing movements and forecasting future ones.

- figuring up an appropriate bid or ask price.

- recognizing and examining the market-depth data as well as historical information about an organization

- speculating on the direction (up or down) of stock market movement.

- estimating the range of prices to come

- identifying patterns in a stock’s pricing

Trading Volume and Its Effect On LTP: What Is LTP In Stock Market-2024

The quantity of shares exchanged at various prices over a given time frame is known as the trading volume. Higher trading volume stocks are less volatile since they add liquidity and don’t move the market as much when it does.

In this instance, the suppliers and purchasers set their preferred prices. A market that is illiquid is created by equities with modest trade volumes, but the gap between the ask and bid prices can get very large. Price volatility is strongly impacted by low traded volume.

In the stock market, the complete form of ATP is the Average Traded Price. It is the average price that buyers have paid throughout time for a single share. The frequency can be weekly, monthly, quarterly, or daily.

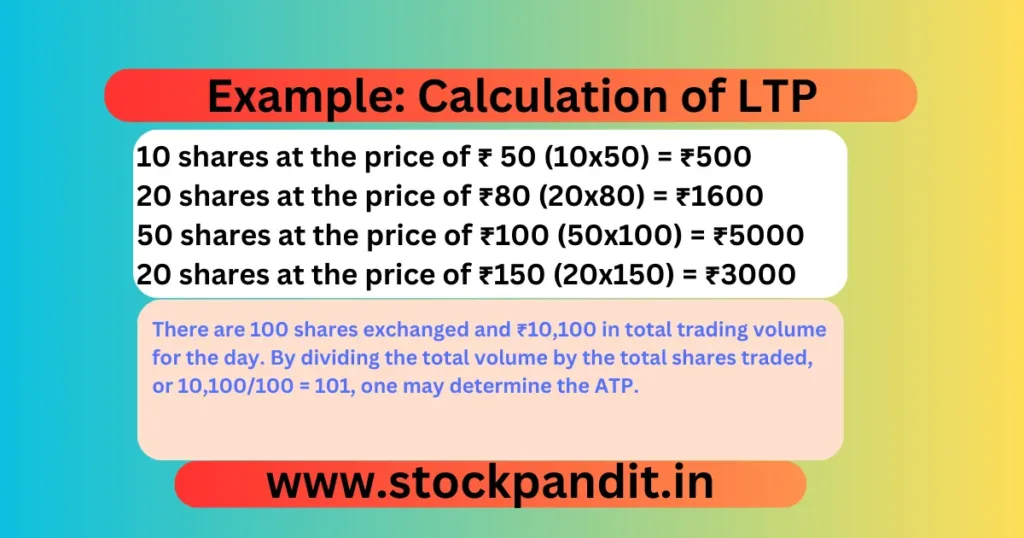

Example: Let’s say that shares of Company X are exchanged in the following way each day:

10 shares at the price of ₹ 50 (10×50) = ₹500

20 shares at the price of ₹80 (20×80) = ₹1600

50 shares at the price of ₹100 (50×100) = ₹5000

20 shares at the price of ₹150 (20*150) = ₹3000

There are 100 shares exchanged and ₹10,100 in total trading volume for the day. By dividing the total volume by the total shares traded, or 10,100/100 = 101, one may determine the ATP.

See this Video for more details

What Impact Does LTP Have on Stock Prices ?

According to conventional wisdom, markets are efficient because they swiftly and precisely factor in all relevant information when determining the price at which stocks trade.

However, even if this were the case, what connection could there possibly be between the average trade and the most recent business ?

This would make sense if we assumed that investors either don’t know how to appropriately assess various types of data or are unable to analyze all available information.

Then, we could argue that investors’ prior knowledge of other investors’ perspectives would be influenced by their familiarity with the companies involved and their past experience with other equities.

What is the formula for LTP ?

How Do They Determine LTP? The last traded price may typically be found on the trading screen against the relevant stock, so there’s no need to manually compute it.

In a nutshell, the price at which the purchase and sell order was most recently completed is the last traded price.

How can I use LTP to trade ?

What is LTP in the Stock Market: Definition, Significance, and Approach…

A lump sum transaction on the stock market is called an LTP.

Here, a buyer and seller sign a contract requiring the seller to sell a predetermined number of shares on a predetermined date for a predetermined price. The number of shares determines the transaction value.

What causes LTP to rise ?

Strong tetanic stimulation of a single pathway to a synapse or several pathways stimulated at different strengths can both cause LTP.

Weakly stimulating one pathway into a synapse results in inadequate postsynaptic depolarization to cause long-term potentiation (LTP).

Are closing price and LTP the same ?

What distinguishes the Closing Price from the Last Traded Price (LTP)? The real last traded price on the market is known as the Last Traded Price (LTP).

The weighted average price of a stock during the final half-hour of trade is known as the closing price.

Are market price and LTP the same ?

However, the closing price and the market price are not the same as the last traded price.

What is the Nifty 50’s LTP ?

The Last Traded Price, or LTP, refers to stock prices. It displays the most recent purchase or sale price of the stock.

Why does LTP matter ?

Learning and memory are linked to long-term potentiation (LTP) of synaptic strength between hippocampus neurons, and memory loss is believed to be caused by LTP dysfunction.

What does LTP simple mean ?

Operationally, long-term potentiation (LTP) is described as a sustained increase in synaptic effectiveness when afferent fibers are stimulated at high frequencies.

What is the duration of LTP ?

It is now clear that LTP can be decremental, lasting hours to weeks, or stable, lasting months or longer, at least in the dentate gyrus.

When LTP is created, what happens ?

The process by which synaptic connections between neurons are stronger with repeated activation is known as long-term potentiation, or LTP.

Learning and memory may be supported by LTP, which is considered to be a way in which the brain adapts to experience.

Does LTP depend on its activity ?

More crucially, it is believed that LTP and LTD, two activity-dependent plasticity mechanisms that stress can directly decrease, are implicated in many of the mechanisms associated with enhanced memory retention, comprehension, and adaptability.