Introduction:

The answer of your question Should You Trade Using the Groww App ? is as follow:

With the rise of online trading apps, the Groww App has gained attention for its diverse investment options. Should you consider using it for trading? Let’s delve into the details and find out.

Diverse Investment Options

The Groww App stands out for offering a wide array of investment options, including stocks, mutual funds, ETFs, AGB IPO, and futures and options trading within a single app. Its range of investment choices rivals that of other brokers, making it a convenient platform for investors with different interests.

User-Friendly Interface and Customer Service

One of the app’s strengths is its user-friendly interface and efficient customer service. Users appreciate the seamless experience provided by Groww, especially in comparison to other platforms. Additionally, the app’s customer service is noteworthy for its quick and effective query resolution, along with features like access to top gainers, losers, and US stock investment options.

Groww Charges 2024

| Trading Segment | Brokerage Charges |

| Equity Delivery | Trades are charged at Rs 20 per executed order or 0.05% of the transaction value, whichever is less. |

| Equity Intraday | Trades are charged at Rs 20 per executed order or 0.05% of the transaction value, whichever is less. |

| Equity F&O | Rs 20 per executed order. |

Should You Trade Using the Groww App ? Limitations in Trading Features

It’s important to note that the Groww App has certain limitations when it comes to trading features and options. Long-term investors seeking a comprehensive platform may find the app lacking in currency and commodity trading, as well as in the availability of charts and indicators.

Important Trading Options and Features

The absence of cover orders and bracket orders on the Groww App may pose challenges for users accustomed to these trading tools. Additionally, the app lacks services such as Stock SIP and the Stagewise Builder tool, which could limit the trading strategies available to users.

Here’s a quick review of the Groww App for stocks and mutual funds.

| Serial Number | Pros |

| 1. | Simple interface and onboarding. A good choice for beginners. |

| 2. | Allows investments in gold, ETFs, IPOs, and mutual funds. Provides fund ratings, research reports, and tools. |

| 3. | No fee and low commissions on fund transfers. SIPs start at Rs100 with low lock-in amounts. |

| 4. | Supports automated advice services and ready-made portfolios. |

| Serial Number | Cons |

| 1. | Research and analysis aren’t as detailed as with traditional brokerages. |

| 2. | Customer service could be better with sometimes slow resolution times. |

| 3. | Main focus on MF investments; limited options for active stock trading. |

| 4. | No support for F&O and commodities trading. |

| 5. | Maintenance fee if the account remains unused for an extended period. |

Conclusion and Takeaways

In conclusion, while the Groww App offers a range of investment options and boasts a user-friendly interface, it has limitations in trading features and options. Long-term investors, in particular, may find its offerings lacking. However, for beginners looking to create a demat account, the app presents a good entry point into the world of online trading.

Conclusion:

Considering the app’s strengths in diverse investment options and user-friendly interface, along with its limitations in certain trading features, potential users should carefully evaluate their trading needs before deciding whether to use the Groww App

FAQ

1. is groww app safe to invest ?

Absolutely !

- Groww is trusted because it adheres to core principles and avoids advisory roles.

- It is a platform that empowers self-directed investment.

- Safety measures

- Data and money are protected by strict checks.

- Personal information is encrypted (256-bit), and vulnerability scans are performed regularly.

- Groww does not handle money directly; all transactions are done through BSE MF Star Platform.

- Data confidentiality and security are assured by adhering to the regulatory guidelines, without any involvement in data laundering.

2. how to invest in groww app ?

- Download the Groww App and Install it: Download the Groww app and install it onto your device.

- Login/Sign Up: Create a new account by entering your name, email address, and mobile phone number. Log in with your existing credentials if you have one.

- KYC verification: Completing the KYC process (Know Your Customer), by providing proof of identity and address in accordance with regulatory requirements.

- Add funds: Securely link your bank account to the app. Start investing by transferring funds to your Groww Account.

- Browse Investment Options: Browse various investment options on the app, such as mutual funds and stocks.

- Choose Investments Select assets based on your risk tolerance and investment goals.

- Investment process: Enter your investment amount and confirm transaction. You can choose to invest in mutual funds as a lump sum or through a SIP (Systematic Investment Plan).

- Track & Manage: Monitor investments via the app. Groww offers tools and insights that help you track the performance of your portfolio.

3. how to withdraw money from groww app ?

- Open the app and log in.

- Navigate to the withdrawal section, select the investment, enter the amount, and confirm.

- Ensure accurate bank details; the withdrawn amount will reflect in your account within a few days.

4. What is the minimum balance in Groww app ?

Groww does not require you to maintain a minimum account balance. You can invest any amount that you feel comfortable with. There is no minimum threshold.

5. how to change mobile number in groww app ?

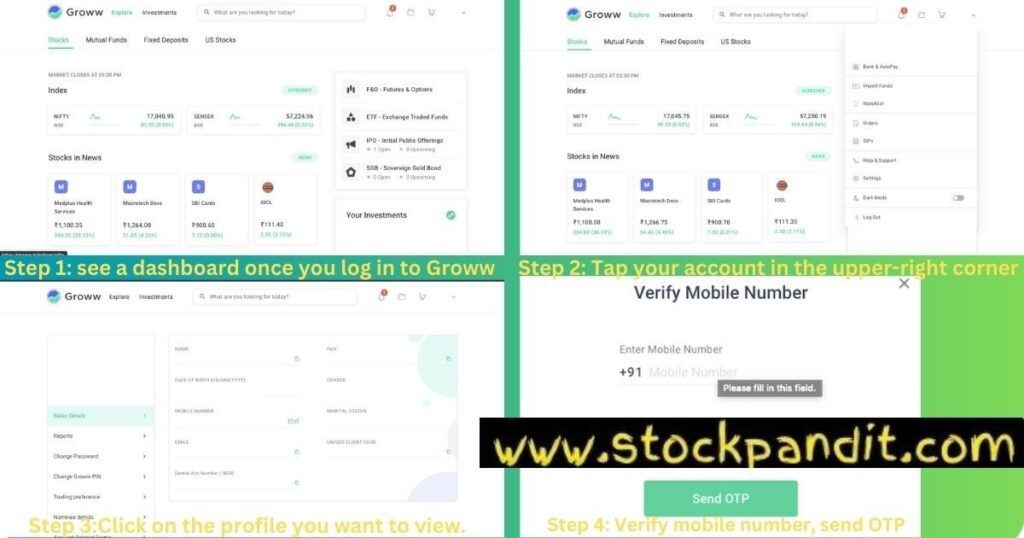

Step 1: Click on Dashboard

You will see a dashboard once you log in to Groww.

Step 2: Tap your account in the upper-right corner.

Step 3: Click on the profile you want to view.

- Step 4: Click the Edit Phone Number button.

- Verify mobile number, send OTP and enter OTP

Once you click on ‘Send OTP,’ an OTP will be sent to your phone number. You just need to enter the OTP.

You have now successfully changed your mobile phone number.