India is gaining momentum with green energy and renewable energy stocks. The country is on its way to achieving the target of 450GW of renewable energy by 2030.

Investors are slowly recognizing India’s growth potential, as it is the third largest energy consumer in the world. Continue reading to learn more about India’s renewable energy stocks, and the best green energy stocks.

A detailed information provided below regarding the Renewable Energy Shares in India 2024

Imagine a world in which the sky is clear, the air fresh, and the natural beauty of our planet is protected. Imagine a world in which we no longer have to worry about fossil fuels’ harmful effects and can instead enjoy renewable and clean energy that is both affordable and available to everyone.

Here is the future we can create by switching to green energy. We can reduce our carbon footprint by adopting renewable and clean energy sources such as solar, wind, and hydropower.

Renewable energy is currently better for the environment because it is more reliable, affordable and sustainable than traditional energy sources.

By switching to greener energy, we can create a more sustainable and brighter future for us and our future generations.

By investing in green energy stocks, it’s time to switch to greener energy to benefit the planet, our health, and our future.

You May Also Like: Adani Power Share Price Target

What are Profitable Green Energy Stocks ?

These companies are environmentally-friendly and planet-saving heroes that harness the power from the sun, wind and water to produce electricity without damaging the environment.

These best penny stocks for renewable energy in India are also the best solar companies in India, which may specialise in clean energy technologies like solar panels, hydroelectric dams, and wind turbines.

These stocks are a good investment and can help you make a more responsible decision to support the transition toward a sustainable and greener future.

If you are interested in being a part of the renewable energy revolution in India, then investing in renewable shares in India is a wise investment.

How do I choose green and renewable energy stocks for investments ?

The best solar stocks in India are among the green investments that target companies in India that have a strong commitment to sustainable development.

We have green portfolios that include companies in India primarily focused on renewable energy sources. Investors can then analyse the use and benefits of green technology, renewable energy and eco-friendly practices. After that, investors can use their environmental, governance, and social performance (ESG), to make informed investment decisions.

Best top 10 Renewable Energy Shares in India 2024

Here is the list of Best Renewable Energy Stocks with market capitalization:

| Serial No. | Company Name | Market Cap | Close Price |

| 1 | Adani Green Energy Ltd | 1,49,112.90 | 936.1 |

| 2 | NHPC Ltd | 52,033.28 | 52.7 |

| 3 | SJVN Ltd | 29,552.06 | 76.2 |

| 4 | Jaiprakash Power Ventures Ltd | 10,143.12 | 14.5 |

| 5 | BF Utilities Ltd | 2,352.53 | 642.9 |

| 6 | Orient Green Power Company Ltd | 2,064.42 | 22.1 |

| 7 | KP ENERGY Ltd | 1,307.57 | 582.1 |

| 8 | Indowind Energy Ltd | 177.1 | 17.1 |

| 9 | Energy Development Company Ltd | 98.56 | 20.4 |

| 10 | Karma Energy Ltd | 70.75 | 64.2 |

The data for the top green companies in India is dated 10th December 2023. Visit the collection for live updates on market trends and energy share prices.

Renewable Energy Stocks: Best Green Energy Stocks in India

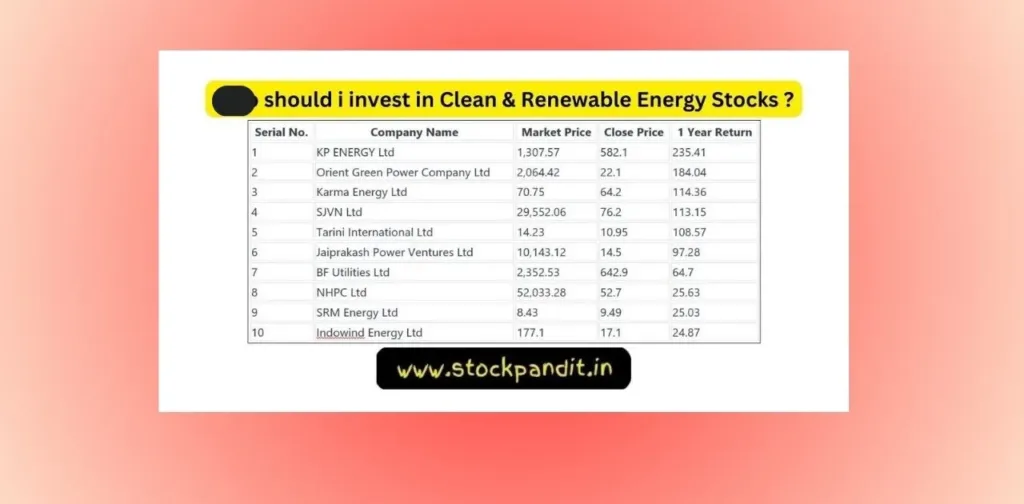

The table below lists renewable energies according to 1 Year Return.

You May Also Like: Best Semiconductor Stocks to Buy in 2024

Best Renewable Energy Shares

The table below lists the best renewable energy shares according to PE Ratio.

| Serial No. | Company Name | Market Cap | Close Price | PE Ratio |

| 1 | Gita Renewable Energy Ltd | 46.82 | 113.15 | 6.31 |

| 2 | BF Utilities Ltd | 2,352.53 | 642.9 | 8.79 |

| 3 | NHPC Ltd | 52,033.28 | 52.7 | 12.12 |

| 4 | Karma Energy Ltd | 70.75 | 64.2 | 12.39 |

| 5 | KP ENERGY Ltd | 1,307.57 | 582.1 | 26.42 |

| 6 | SJVN Ltd | 29,552.06 | 76.2 | 29.21 |

| 7 | Energy Development Company Ltd | 98.56 | 20.4 | 47.76 |

Renewable Energy Stocks

The table below lists renewable energies in order of the highest volume:

| Serial No. | Company Name | Market Cap | Close Price | Daily Volume |

| 1 | Jaiprakash Power Ventures Ltd | 10,143.12 | 14.5 | 17,98,96,724.00 |

| 2 | Orient Green Power Company Ltd | 2,064.42 | 22.1 | 3,32,94,919.00 |

| 3 | SJVN Ltd | 29,552.06 | 76.2 | 2,65,32,739.00 |

| 4 | NHPC Ltd | 52,033.28 | 52.7 | 2,06,01,049.00 |

| 5 | Adani Green Energy Ltd | 1,49,112.90 | 936.1 | 3,41,144.00 |

| 6 | BF Utilities Ltd | 2,352.53 | 642.9 | 1,99,821.00 |

| 7 | Energy Development Company Ltd | 98.56 | 20.4 | 1,99,411.00 |

| 8 | Indowind Energy Ltd | 177.1 | 17.1 | 1,69,751.00 |

| 9 | Agni Green Power Ltd | 49.13 | 24.75 | 35,000.00 |

| 10 | KP ENERGY Ltd | 1,307.57 | 582.1 | 31,014.00 |

| 11 | Karma Energy Ltd | 70.75 | 64.2 | 17,239.00 |

Types of green energy stocks

We have listed some of the direct green energy shares in India.

Clean Energy Stocks: Green Energy Penny Stocks in India for companies that provide and produce clean and renewable energy such as solar and wind energy.

Stocks of solar energy in India: These are companies that manufacture solar panels, provide installation services, and produce solar panels for residential, utility-scale, and commercial solar power projects.

Wind Energy Stocks in India: These green stocks are composed primarily of wind energy companies located in India. This includes companies that manufacture wind turbines and companies that provide installation services for offshore and onshore wind farms.

Hydro power stocks: Companies operating hydroelectric power stations that can generate electricity by using the natural flow of water.

Stocks in geothermal energy companies: Companies which develop geothermal plants, which can produce electricity by harnessing earth’s heat.

Bioenergy Companies who can potentially produce biofuels such as biodiesel and ethanol, and operate biomass energy plants using organic matter.

You May Also Like: Wipro Share price target:

Our Green Energy Portfolios

Budget Union 2023-24 focuses on embracing sustainable development.

Green Growth was founded on the vision of LIFE, or Life for Environment.

The Government of India has set a target of zero carbon emissions by 2070 and is offering Rs 35,000 crores for energy transition goals.

The National Green Hydrogen Mission, recently launched, facilitates the transition of the economy to a low-carbon intensity by producing 5 MMT annually by 2030.

Green Energy Stocks: Factors to consider before investing

Government Policy: Analyse government policies and incentives to determine the impact on green energy.

Innovation: Look out for companies who invest in new technologies and innovation. They have a higher chance of growth.

Competition: Evaluate market trends and competition in the green energy sector, and invest in firms that have an edge.

ESG performance: Take into account the company’s environmental and social performance (ESG), which is a good indicator of long-term sustainability.

Risk: Assess the risks associated with green energy stocks NSE including regulatory and technology risks.

Diversification: To minimize risks and maximize return, diversify your portfolio through the purchase of multiple green energy stocks.

Long Term Perspective: The industry is still in its early stages and it may take some time for the returns to be realized.

Commitment to environmental responsibility

Green energy stocks in India are dominated by companies that have a strong commitment to the environment. These companies prioritize renewable sources of energy such as wind, solar and hydropower.

These firms are committed to eco-friendly energy solutions and their operations reflect this.

Resilience in the face of economic fluctuations

Green renewable energy penny stocks are resilient to economic fluctuations. The global focus on sustainability is a major factor in this resilience.

Investments in renewable energy stocks in India are more stable than in some traditional sectors as the world shifts to cleaner energy alternatives.

Support and Initiatives of the Government

In India, green energy stocks benefit from government initiatives and support. Clean energy policies play a crucial role in increasing the growth potential of green power stocks. Investors who are interested in green energy can benefit from the regulatory support.

Innovation and Technological Advancements

Green energy is marked by constant innovation and technological advances. Research and development companies that are developing cutting-edge technology for renewable energy solutions can experience significant market gains.

This innovation-centric approach adds a dynamic to the investment landscape.

Take into consideration the regulatory landscape

Investors who are interested in green energy penny stocks in India should be aware of the regulatory environment. These green energy penny stocks in India can be affected by government intervention and policy changes.

It is important to stay informed about regulatory changes to make well-calculated, informed investments in this rapidly changing and transformative industry.

Green Energy Stocks: Risks to Investing

Here are some risks associated with investing in Solar Energy Stocks or Green Energy Stocks.

Thermal Energy: Heavy Reliance

India’s predominant dependence on thermal energy (specifically coal-based electricity) is 75% by FY 2022-2023. This dependency is due to the availability of fossil fuels and their cost-effectiveness.

Transitioning to alternative sources of energy is a slow process. This makes it difficult for a sudden shift. The green energy penny stock list for 2024 also includes it as one of the most popular shares.

Renewable Energy Production and Distribution Challenges

The challenges of renewable energy extend beyond the production of green shares to the maintenance, distribution and storage of their resources.

Solar and wind power are limited by their inconsistency, which is tied to the availability of sunlight and wind. Unpredictability in the supply of green energy is a barrier to reliable and consistent distribution.

Demand-Supply Gaps and Peak Energy Needs

The challenge of addressing the gap between demand and supply is particularly difficult in India, given the increased energy needs in the evening. It is difficult to maintain a steady and continuous energy supply due to the fluctuating demand patterns.

Intermittence of renewable sources and seasonal variations

Solar and wind energy are subject to the natural conditions. The sun is only available during daylight hours and the wind patterns are influenced by climate and geography.

Intermittency, seasonality and geography all contribute to an unreliable and inconsistent supply of clean energy.

Energy Storage Solutions: Cost-Effective Solutions

The current cost effectiveness of energy storage methods, notably batteries, is a major barrier. The costs associated with advanced energy storage technologies prevent their wide adoption.

Further advancements and reductions in cost are needed to integrate renewable energy into the landscape.

Battery Storage: A Sustainable Solution

Batteries are a viable option for renewable energy storage. Despite the challenges they face, batteries have a lot of potential.

Technological advances and improved infrastructure may pave the path for cost-efficient, scalable storage solutions of batteries that will facilitate the transition to a more sustainable and greener energy future. AK Saxena, of TERI says that despite these obstacles, 42% of India’s energy can be sourced through renewables by 2030.

What are the benefits of investing in clean energy stocks in India ?

Investing green energy stocks in India is a great way to support the environment and potentially earn profit. Learn how to:

Growing Industry: The clean-energy industry is growing rapidly, so investing in it will yield high returns.

Sustainability: Clean sources of energy like solar, wind and hydro will continue to produce power in the future.

Reduced carbon footprint: Clean Energy helps reduce carbon emissions, which is good for the planet.

Green Job creation: Clean energy industries create new jobs and contribute to economic growth.

Diversification By investing in clean energy stocks, you can diversify your portfolio and reduce risks while increasing returns.

Positive impact: By purchasing clean energy stocks in India NSE, you will be supporting companies that have a positive impact on the environment and society.

Government support: Governments around the world provide incentives and subsidies to clean energy companies, making them good investments.

Who should i invest in Clean & Renewable Energy Stocks ?

It is recommended that you invest in renewable and clean energy stocks in India, if you are concerned about the environment and sustainability.

These renewable energy penny stocks in India are a great way to invest in businesses that prioritize eco-friendly practices. If you are looking to make long-term investments in green energy and contribute to a sustainable future, this can be a great deal.

You can earn good returns by investing in the best and cleanest renewable energy stocks available in India.

It is strongly recommended that investors should always do their research or consult their financial advisors before investing.

Conclusion

In conclusion, India’s green energy and renewable stock industry is a sector that has immense potential. If green energy shares are of interest to you, there are many ways that you can turn your portfolio into a green one.

FAQs: