What is Price-to-Equity ? The P/E ratio is a financial measure that evaluates a company’s share price in relation to its earnings-per-share (EPS). The price-to-earnings ratio is calculated by dividing market share prices by earnings per share.

Understanding the Price-to-Equity:

Calculation: P/E Ratio = Market Price per Share / Earnings per Share

Interpretation:

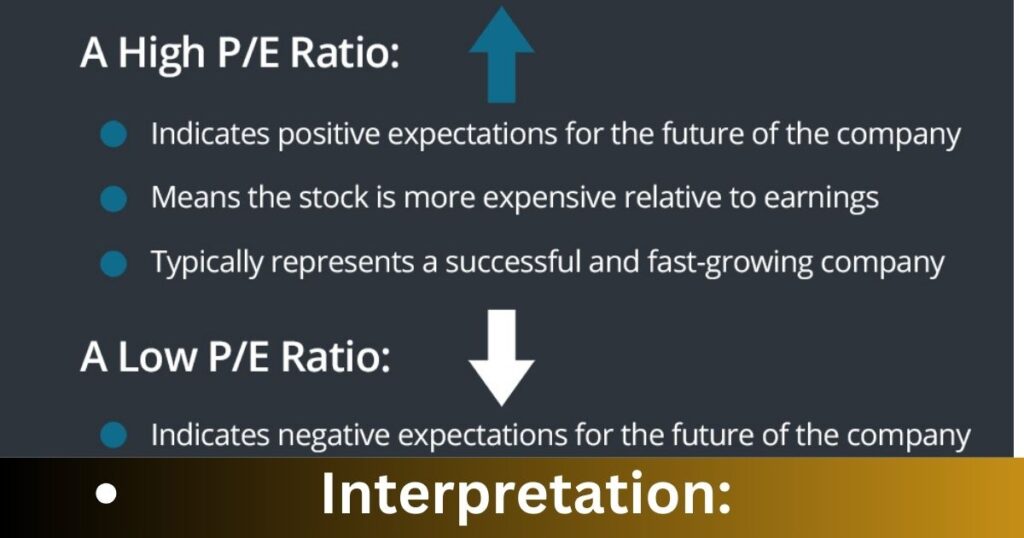

- A high P/E ratio suggests that investors are expecting higher earnings growth in the future.

- A low P/E ratio may indicate undervaluation or a lack of growth expectations.

Variations:

- Forward P/E considers estimated future earnings rather than past performance.

- Trailing P/E uses historical earnings data.

Significance of Price-to-Equity:

- Comparative Analysis: Helps compare companies within the same industry or sector.

- Investor Insight: Indicates market perception about a company’s growth potential.

- Risk Assessment: High P/E ratios might suggest higher risk if future earnings growth doesn’t meet expectations.

- Market Sentiment: Reflects investor confidence or skepticism about a company’s future prospects.

Factors Influencing Price-to-Equity:

- Industry Trends: Different sectors might have different average P/E ratios due to varying growth expectations.

- Economic Conditions: Market sentiment can impact P/E ratios during economic upturns or downturns.

- Company Performance: Strong earnings growth often correlates with higher P/E ratios.

Application in Investment:

- Valuation Tool: Assists in determining if a stock is overvalued or undervalued.

- Risk Assessment: High P/E ratios may pose higher risk if future growth doesn’t meet expectations.

- Long-term Perspective: Provides insights into the market’s perception of a company’s future potential.

Understanding the price-to-earnings ratio aids investors in evaluating a company’s stock by considering its earnings performance in relation to its market value, providing valuable insights into market expectations and potential investment opportunities.

You May Also Like: Which Nifty Bees is Best

The price-to-earnings (P/E) ratio serves as a critical financial metric that provides insight into several aspects of a company’s performance and market perception:

Valuation:

- Relative Value: Indicates whether a stock is undervalued, overvalued, or fairly priced in comparison to its earnings.

- Benchmarking: Helps compare a company’s P/E ratio with industry peers to assess relative valuation.

Investor Expectations:

- Growth Expectations: A high P/E ratio suggests investors anticipate strong future earnings growth.

- Market Sentiment: Reflects investor sentiment about the company’s prospects and market perception.

Risk Assessment:

- Risk Perception: High P/E ratios might indicate higher risk if future earnings fail to meet optimistic expectations.

- Volatility: Can be influenced by changes in earnings, market sentiment, or economic conditions.

Earnings Performance:

- Profitability: Reflects the company’s earnings relative to its market value.

- Historical Analysis: Trailing P/E uses past earnings, while forward P/E incorporates future expected earnings.

Investment Decision-making:

- Long-term Prospects: Helps investors assess the potential for future growth and returns.

- Value Investing: Guides investors seeking undervalued stocks based on lower P/E ratios.

- Growth Stocks: High P/E ratios often align with companies expected to achieve significant growth.

Comparative Analysis:

- Industry Comparison: Enables comparison of companies within the same industry or sector.

- Benchmarking: Aids in evaluating a company’s performance against market standards.

Market Perception:

- Market Confidence: High P/E ratios can signify confidence in the company’s growth potential.

- Investor Sentiment: Low P/E ratios might suggest skepticism or undervaluation.

Is a high or low PE ratio better ?

The context will determine whether a low or high price-to earnings (P/E ratio) is more beneficial. A high P/E often indicates that investors expect robust earnings growth in the future, which can lead to higher returns. However, it also means higher risk when growth does not meet expectations.

Low P/E may indicate undervaluation, or slower growth prospects. This could be an opportunity for value-oriented investors looking for bargains. High P/E ratios can be a good thing, as they indicate growth potential. Low P/Es may signal undervaluation.

Overall, the P/E ratio is a versatile tool providing a snapshot of market sentiment, investor expectations, and the relative valuation of a company’s stock. It aids investors in making informed decisions about investing in stocks based on growth prospects, market trends, and risk assessment.