Unveiling the Success Story of Polycab: A Pioneer in the Electrical Industry

Introduction

In the vast landscape of the managed wire and cable industry, one company stands out as the undisputed leader – Polycab.

In this article you will read about Polycab Share Price Target 2024. With a staggering quarter of the market share, Polycab has not only dominated the cables and wires sector but has diversified its product range to include LED lights, fans, solar inverters, pumps, switches, and switchgear.

Market Presence

Polycab’s footprint is extensive, operating over 2 lakh retail locations nationwide and collaborating with over 4000 distributors. The company’s widespread reach makes it a household name, symbolizing trust and quality.

Financial Triumphs

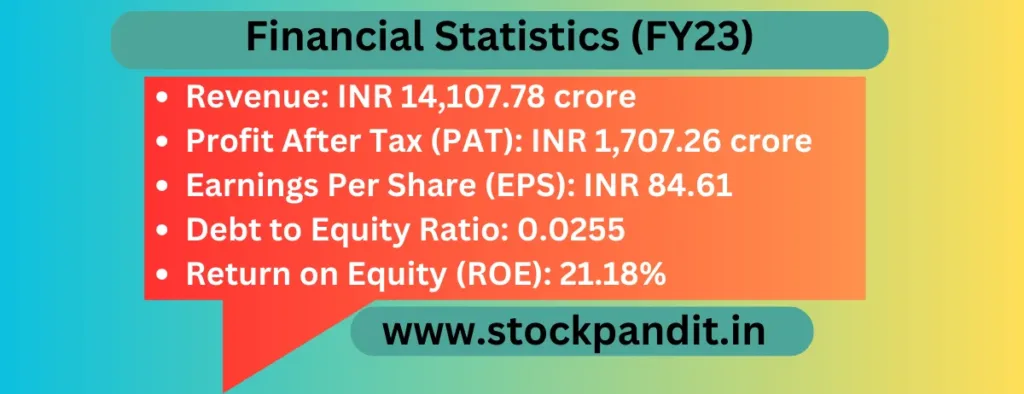

Post its 2019 IPO on the stock exchange (NSE: POLYCAB & BSE: 542652), Polycab has witnessed unprecedented growth, boasting a remarkable 700% surge, with 2023 alone marking a spectacular 100% increase. Let’s delve into the financial indicators that paint a picture of Polycab’s fiscal prowess:

Financial Statistics (FY23)

Stock Projections

Curious about Polycab’s future stock performance? Our bespoke deep learning system forecasts intriguing insights into the next 10 to 15 years.

Stock Predictions: Polycab Share Price Target 2024, 2025, 2027, 2030, 2032, 2035

- 2024: Estimated to rise to ₹7,293.54 per share

- 2025: Projected at ₹11,331.66 per share

- 2026: Targeting ₹15,617.08 per share

- 2027: Anticipated to reach ₹20,138.19 per share

- 2028: Could climb to ₹24,922.45 per share

- 2031: Aiming for ₹37,927.69 per share

- 2035: Potential peak at ₹55,609.39 per share

Historical Development

To comprehend Polycab’s journey, let’s rewind to its inception. In 1964, Sind Electric Stores was established in Mumbai, laying the foundation for what would become Polycab. Thakurdas Jaisinghani’s legacy was carried forward by his sons, with the establishment of Thakur Industries in 1975 and the birth of Polycab Industries in 1983.

Second-Generation Leadership

The mantle was passed to the second generation, with Nikhil and Bharat, sons of key figures in the company, injecting fresh energy in 2006. Venturing into the Fast Moving Electrical Goods (FMEG) industry in 2014 marked a strategic move, propelling Polycab to a major force in the Indian electrical landscape.

Latest Advancements

Core Business Operations

Understanding Polycab’s core functions is crucial:

Operational Landscape

- Production: 26 production facilities nationwide crafting wires and cables for diverse applications

- Distribution: An extensive network of over 25,000 channel partners ensuring product availability and market reach

You May Also Like:

Tata Consultancy Services Share Price Target 2024

Conclusion

As we navigate through Polycab’s remarkable journey, it’s evident that the company’s trajectory is poised for continuous upward momentum. The blend of historical significance, financial prowess, and strategic foresight makes Polycab a formidable force in the electrical industry.

Is it good to invest in Polycab share?

In its research report dated January 19, 2024, Sharekhan, who is positive on Polycab India, advised a buy recommendation on the stock with a target price of Rs 5510. For Polycab India, Sharekhan has suggested a buy rating with a target price of Rs 5510.

What potential does Polycab have going forward?

Prospective Development

Revenue and earnings growth for Polycab India are anticipated to increase by 13.8% and 13.7% annually, respectively.

The predicted annual growth rate for EPS is 12.7%. In three years, a return on equity of 18.9% is anticipated.

Is Polycab Capable of Multibagging?

Even with the sharp decline, it’s still a multibagger because we joined the targeted portfolio in 2021. To begin with, Polycab—which we included in our Focused portfolio with a 5.5% allocation—is currently receiving negative press.

What factors contributed to Polycab’s remarkable 700% growth post its 2019 IPO?

Polycab’s growth can be attributed to strategic market positioning, product diversification, and a robust financial management strategy.

The company’s IPO marked a turning point, attracting investors and fueling expansion plans.

How does Polycab maintain its extensive network of over 2 lakh retail locations and 4000 distributors?

Polycab places a strong emphasis on relationship-building and customer satisfaction. Regular engagement with distributors, quality assurance, and timely delivery contribute to the company’s extensive and reliable network.

Can you elaborate on Polycab’s involvement in R&D, sustainability projects, and global market expansion?

Polycab actively invests in research and development to stay ahead in technological advancements. Sustainability initiatives underscore its commitment to eco-friendly practices, and global market expansion involves strategic collaborations and market analysis.

What role do Nikhil and Bharat, the second-generation leaders, play in steering Polycab’s success?

Nikhil and Bharat bring fresh perspectives and innovation to Polycab. Their leadership has been instrumental in expanding the company’s product line, entering new markets, and ensuring continuity of the Jaisinghani family legacy.

How does Polycab navigate challenges and market fluctuations within the electrical industry?

Polycab’s adaptability, market insights, and strategic planning enable it to navigate challenges effectively. Continuous monitoring of industry trends and proactive measures contribute to its resilience.

Tell us more about Polycab’s strategic alliances with top companies in the building and electrical industries.

Polycab’s strategic alliances involve collaborations with industry leaders to execute projects efficiently. These partnerships enhance the company’s capabilities, ensuring it remains at the forefront of innovation.

What innovative products has Polycab introduced in response to rising market demands?

Polycab has introduced innovative and energy-efficient cables, addressing the evolving demands of the market.

These products showcase the company’s commitment to staying ahead in technological advancements.

How does Polycab ensure product availability and market reach through its distribution network?

Polycab’s extensive distribution network of over 25,000 channel partners ensures widespread availability.

This network, coupled with efficient logistics, guarantees that Polycab products reach every corner of the market.

What are the key factors influencing Polycab’s stock price predictions for the next 10 to 15 years?

Stock predictions are influenced by market cycles, volume movements, and price swings. Polycab’s strong financial performance, market dominance, and strategic initiatives contribute to positive forecasts.

Can you provide insights into Polycab’s potential for global market expansion in the coming years?

Polycab’s global expansion is fueled by strategic initiatives and collaborations. The company aims to leverage its expertise and reputation to explore new markets, ensuring sustained growth in the global arena.