What is NPA meaning in banking ?. NPA is short for nonperforming assets. This can be a major issue for the global financial sector. Banks and financial institutions are faced with the challenge of managing nonperforming assets as loans and advances go bad.

Investors, borrowers and financial institutions can benefit from a better understanding of NPAs in Indian banks to help them navigate through the challenges presented by these assets, and move towards a more resilient and healthy banking system.

This blog will explore the complexities surrounding Non-Performing Assets, and explain what NPA is, as well as how to calculate NPA. We will also examine the causes, impacts, and measures used to address them.

What are NPA in Banking ?

The term non-performing asset refers to loans and advances that are no longer generating income for banks or financial institutions.

NPAs are assets in the banking industry that are nonperforming when a borrower does not make timely principal and interest payments for a certain period of time, typically 90 days or longer. NPAs are a sign of heightened risk for default and financial instabilities.

These include a variety of loan types, including personal loans, business and mortgage loans, as well as credit card debt. The banks are trying to reduce NPAs because they affect profitability and need provisioning for possible losses.

Examples of non-performing assets of banks include:

- Non-Performing Loans in Banking

- Defaulted mortgages

- Credit card debt

- Overdue business loan

- Corporate bad debts

- Agriculture: Non-performing Assets

How Do Non Performing Assets Work ?

Banks and financial institutions record non-performing assets on their balance sheets. Lenders take action to recover outstanding debts when borrowers fail to pay their loans consistently.

The lender can seize the collateral assets if the borrower has pledged them as security. If no collateral is pledged, a lender can classify the loan and sell it at a discount to a collection agency.

This is usually based on a 90-day period of nonpayment. This timeframe can vary depending on loan terms. You can identify a non-performing loan at any time during the term of the loan or at maturity.

You May Also Like: What is Average Trade Price in Stock Market ?

Non-Performing Assets in Different Sectors: NPA meaning in banking

You can find non-performing assets (NPAs), in many sectors of the economic system. Here are some examples:

i). Sub-Standard assets

A non-performing asset (NPA), or asset that is not performing, can be classified as falling below the standard if its status remains unchanged for less than 12 months.

ii) Doubtful Assets

If an asset has been labelled in question for longer than 12 months, it is considered a non-performing asset.

iii) Loss Assets

Loss assets are those that have a minimal value or become “uncollectible”. This means they can no longer be considered as bankable assets. The asset may still have some value, even though it has been written off.

Calculation of Gross Non-Performing Assets Ratio and Net Non-Performing Assets ?

What is the Gross NPA Ratio (GNR) ?

The gross NPA or GNPA is calculated by dividing total gross non-performing assets by total assets. Total gross NPAs is the amount of all loans classified as non-performing after 90 days.

Total assets are the value of the bank’s total assets including cash, loans, and investments. The formula for the gross NPA can be written as:

Gross Non-Performing Asset Ratio = Total Gross NPAs / Total Assets

The ratio of Gross NPA to Net NPA is an important metric used to gauge the financial health of a bank. Learn how to calculate them.

What is Net NPA (Net Profit After Tax) ?

Calculate the net NPA by subtracting the provisions from the gross NPAs. Provisions are the amounts that banks reserve to cover NPA losses. The formula for the net NPA ratio can be expressed as:

Net non-performing asset = Gross NPAs + Provisions

Net NPA measures the actual losses incurred by a bank on its NPAs. A high net NPA is a sign that the bank has suffered large losses from its NPAs. This could be an indication of financial difficulties for the bank.

NPA and Gross NPA Examples

Let’s say a bank has outstanding loans totaling Rs10,00,000. Of these loans, Rs 2,00,00,000 is classified as non-performing loans or bad loans.

The bank’s gross non-performing asset would be Rs 2,00,00,000. This is because the value of the non-performing loans totals this amount.

Let’s say the bank made provisions for Rs50,000,000 to cover the non-performing loan. In this situation, the Net Non-Performing Loans would be calculated after subtracting the provisions.

The Net Non-Performing Asset is Rs2,00,00000 minus Rs50,00000 = Rs1,50,00,000.

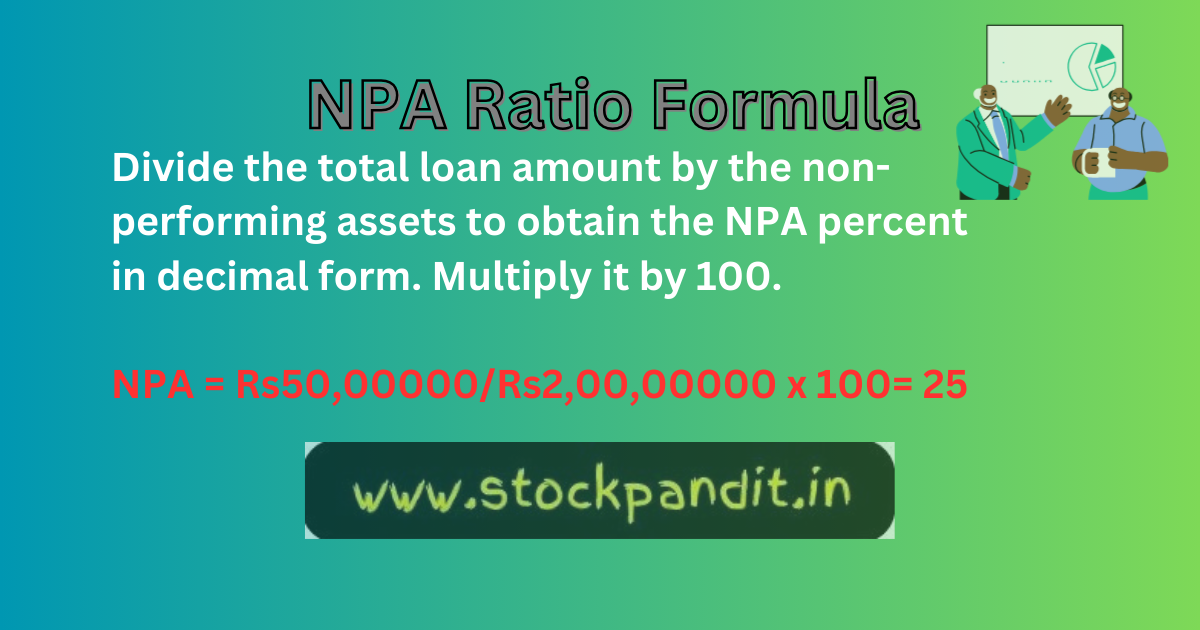

NPA ratio formula

Divide the total loan amount by the non-performing assets to obtain the NPA percent in decimal form. Multiply it by 100.

NPA = Rs50,00000/Rs2,00,00000 x 100= 25

What happens to non-performing assets ?

There are two scenarios for non-performing assets:

a) If assets have been pledged to secure the loan and the borrower continues to default, the lender can take legal action to force the borrower to liquidate those assets.

If there are no assets available, the lender may classify the loan due to prolonged non-payment as bad debt. The lender may also transfer the NPA to a collection agency for a discounted price.

You May Also Like: What is PE Ratio Today

What are the Causes of NPA ?

Some of the causes of Non-Performing Asset are as follows:

Economic Downturns: When the economy is in a downturn, businesses may experience financial difficulties and may be unable to repay their loans.

- Borrower Fraud:

In some cases, borrowers may deliberately default on their loans to avoid repaying them.

- Poor Lending Practices:

Banks may make loans to borrowers who are not creditworthy. This can lead to NPAs if the borrowers are unable to repay their loans.

Lack of Monitoring: Banks may not adequately monitor borrowers’ repayment records, which can lead to NPAs.

- Changes in the Economic Environment:

Changes in the economic environment, such as a rise in interest rates or a decline in commodity prices, can make it more difficult for borrowers to repay their loans.

NPA Impact on Banks, the Economy, and Borrowers.

Banks face challenges due to NPAs

When it comes to non-performing assets, banks face many challenges. These challenges include:

- Financial losses:

Non-performing loans hit banks the hardest – in their pockets. Banks suffer financial losses when borrowers do not repay their loans. They are unable to recover principal and interest.

- Provisioning pressures:

According to regulatory guidelines, banks set aside provisions in case of non-payment. A higher NPA rate can lead to larger provisions. This may strain the bank’s finances. This is like saving money for a rainy day that never seems to come.

- Liquidity Problems:

Non-performing assets (NPAs) can eat up a large portion of the bank’s resources. It can be difficult for banks to meet their liquidity needs and lend money. This can hinder the bank’s capacity to grow and generate revenue.

- Credit Quality Concerns:

NPAs signal deteriorating asset quality, which can raise red flags for lenders. Credit rating downgrades may follow, increasing borrowing costs for the bank and shaking investor confidence. It’s like having a black mark on your credit history that may be hard to shake off.

- Reputation at Stake:

High NPAs can tarnish a bank’s reputation and shake customer trust. If people start losing faith in a bank’s ability to recover loans, they may withdraw their deposits. And take their business elsewhere. It’s like a domino effect that can further weaken the bank’s financial standing.

The impact of non-performing assets on borrowers

Non-performing assets affect borrowers and banks alike. Here’s how:

- Creditworthiness

When a loan becomes a non-performing asset, it negatively affects a borrower’s creditworthiness. It becomes difficult for them to obtain credit or loans in the future. They may be viewed as high-risk by lenders, which can limit their access to resources.

ii) Legal Consequences

If the borrower does not repay the loan, the lender may take legal action to recover the amount owed. It can result in litigation which increases the financial burden of the borrower and damages their credibility.

iii) Asset seizure

In some cases, banks can seize and sell collateral that the borrower has provided to recover outstanding loan amounts. The borrower may suffer a financial loss due to the seizure of valuable assets.

iv) Limited Options Borrowers

who have NPAs are in a difficult position when trying to obtain additional financing. It may be difficult for them to obtain new credit or loans, which could affect their ability to meet financial needs.

v) Credit History:

A loan’s NPA status is recorded on the credit history of the borrower and can have serious long-term effects. This information can be accessed by other lenders such as banks and financial institutions to assess creditworthiness.

If there are NPAs on your credit report, you may be subject to higher rates of interest, stricter terms for borrowing, and fewer options.

How to manage and address non-performing assets (NPAs)

Role of Regulatory Authorities in NPA Management:

The regulatory authorities have a key role to play in the management of non-performing assets. This can be done by:

Establishing standards for loan classification and provisioning

Regulatory authorities can set standards on how banks and financial institutions should classify loans, and how much provisioning they need to make for non-performing assets. This will ensure that the banks are prepared for possible loan defaults.

Monitoring NPA Levels:

Regulators can monitor NPA levels in banks and address any problems that might arise. They may, for example, require that banks take steps to reduce Non-Performing Assets (NPAs) or increase their provisioning to cover NPAs.

Guidance and support:

Regulators can offer guidance and support for banks and other financial institutions in managing NPAs. It may be necessary to provide information about best practices, develop training programs, and offer technical assistance.

Banks’ strategies for NPA resolution

To resolve Non-Performing Assets, banks employ different strategies. These strategies can be divided into two categories:

Preventive Measures are designed to reduce the risk of loans turning into non-performing assets. These include:

Here are some prevention measures to avoid non-performing assets:

- Credit Risk Assessment: Due Diligence and Assessment of Credit Risk are Important

Credit risk assessment is a process that evaluates the likelihood of a borrower defaulting on a loan. It is recommended that banks and other lending institutions conduct thorough credit risk assessment and due diligence before making loans. It may be possible to identify those borrowers more likely to default and to avoid lending to them.

ii) Effective Monitoring and Recovery Mechanisms

Banks and other lenders must monitor the borrower’s repayment performance regularly after approving the loans. It may allow them to detect potential problems earlier and prevent them from becoming non-performing assets.

Banks and other lenders need to intervene quickly if a borrower has difficulty repaying the loan. It may be necessary to provide financial counselling or to restructure the loan terms.

iii) Strengthening risk management practices in the banking sector

Banks and other lenders should have a system for tracking and reporting NPAs. It may allow them to spot trends and take action to resolve any issues.

Banks and other lenders who take these measures can reduce the risk of NPAs.

Conclusion

Nonperforming Assets continue to be an important concern for the Financial Sector, with implications that are far-reaching for banks, borrowers and the economy as a whole.

In order to reduce the risk of non-performing assets (NPA), improve asset quality and strengthen financial health, proactive measures are needed. The management and resolution NPAs are improved through effective credit assessment, robust monitoring mechanisms and strict regulatory oversight.

FAQ:

What are examples of non-performing assets ?

NPA and Gross NPA Examples

Let’s say a bank had total outstanding loans worth Rs10,00,000. Of these, Rs 2,00,00,000. are classified as bad or non-performing loans.

The bank’s Gross non-performing asset would be Rs 2,00,00,000.

This is because the value of all non-performing loans equals that amount.

What are three examples of non-performing assets (NPAs) ?

Non-Performing Assets: Types

- Sub-Standard Assets. A sub-standard asset has remained as a non-performing asset for less than 12 months.

- Doubtful assets. A doubtful asset has been classified as an NPA (non-performing asset) for over 12 months.

- Loss Assets.

What is the difference between NPAs and NPLs ?

A non-accrual loan refers to a debt for which the lender no longer earns interest because it is 90 days past due or more.

A non-performing loan (NPL) refers to a loan for which the borrower has not made scheduled payments over a certain period, usually 90 or 180 calendar days.

What are the different types of NPA ?

Sub-standard Asset: An asset that has been non-performing for less than 12 months or more is considered a sub-standard asset.

Doubtful assets are assets that have been NPA for longer than 12 months. Loss Asset: A non-performing asset that has been inactive for over 3 years is considered a loss asset.

Can NPA sold ?

Understanding NPA:

The lender may force the borrower, after a prolonged period of nonpayment, to liquidate assets pledged as part of the agreement.

In the absence of such assets, a lender may write off an asset as a bad loan and sell it to a collection agency at a discounted price.

What are some examples of non-financial asset ?

Non-financial Assets include tangible assets such as land and buildings, motor vehicles and equipment as well as intangible assets such as intellectual property, patents and goodwill.

What are the risks of NPA ?

The importance of NPAs

If the asset is not performing and the interest payments aren’t made, this can harm the borrower’s credit and growth opportunities.

This will affect their future borrowing ability. Interest earned by the lender or bank is their main source of revenue.

What is D1 in NPA ?

NPA Management: Basic Concepts

The rules are different for agricultural loans. Banks are also required to further classify non-performing assets into three categories:

Substandard, Doubtful, and Loss Assets

D1 for less than a year

D2 for 1 to 3 years

D3:>3 Years

Substandard assets are NPAs that have been NPA for less than 12 months.

What is NPA according to RBI ?

A ‘non-performing asset’ (NPA), was defined by as credit for which interest and/or installments of principal have remained “past due” for a specified period .