5 Best Chemical Stocks to Keep an Eye On

The companies manage their funding needs through internal cash or equity. Internally generated cash is the most preferred funding source, followed by equity and debt, mainly due to associated costs.

Debt-Free Penny Chemical Stocks 2024: Some companies claim to be debt-free or to have no debt, indicating to their stakeholders that they can manage to fund themselves primarily through cash generated internally. They are therefore cash-rich businesses.

Here are five debt-free chemical stocks to add to your watchlist: Debt-Free Penny Chemical Stocks 2024

Whenever we invest, the biggest question that comes is that what are the fundamentals of the company in which we are investing and what will be its future.

Although there are many factors which we should check before investing but a simple investor does not understand all the figures. Here I am giving some important figures which will give you an idea about what the future of the company is going to be.

Because our investment is safe only when the fundamentals of the company are good. That is why it is very important to take a look at the fundamentals of the company before investing.

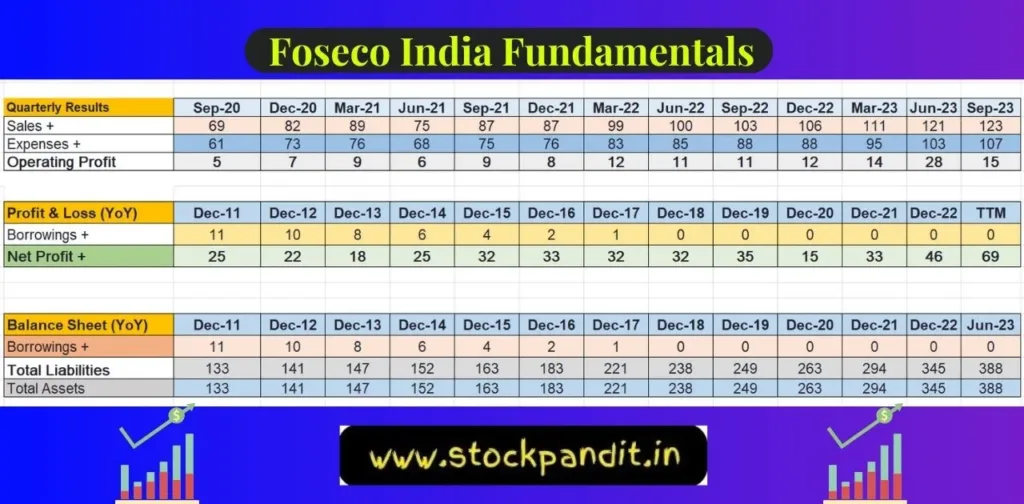

Fundamental of Foseco India

Foseco India manufactures products for the metallurgical sector. These are additives and consumables which improve the physical and performance properties of castings.

The company’s debt-to-equity ratio is zero and its total debt is also zero. The company is a small-cap stock with a Rs 2,314 billion market capitalization.

Its shares closed at Rs 3543.85 each. The share price of the company has increased by almost 100 percent in the last year. This is a multibagger return.

You May Also Like : Renewable Energy Shares in India 2024

Fundamental of Tanfac Industries

Tanfac Industries was promoted by Aditya Birla Group, and Tamil Nadu Industrial Development Corporation. It is one of the world’s leading producers and distributors of Hydrofluoric acid.

The company’s debt-to-equity ratio is zero and its total debt is also zero. The company is a small-cap stock with a capitalization of Rs. 1,845 crores. Its shares were settled at Rs. 1908.95 each.

The company’s shares have increased 263.23 percent in the last year. This has led to multi-bagger returns.

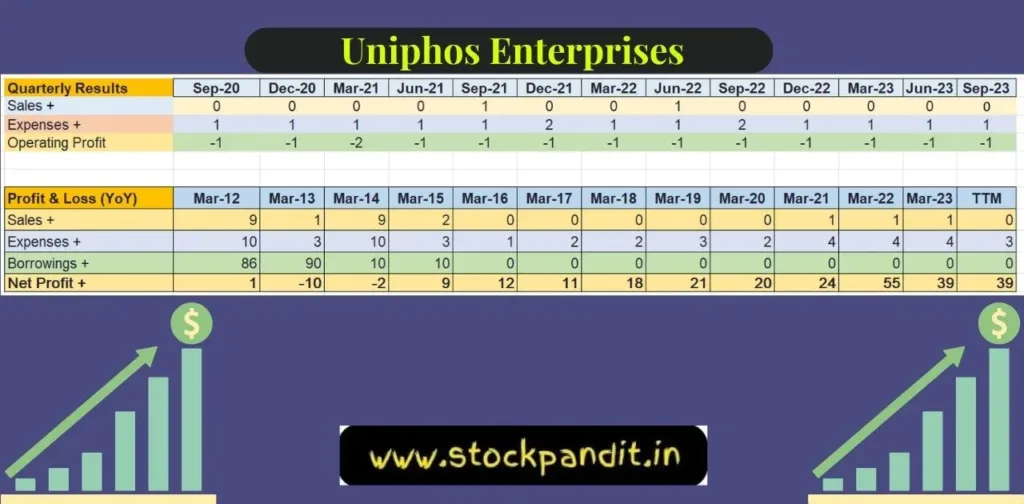

Fundamental of Uniphos Enterprises

Uniphos Enterprises. Currently, the company is engaged in trading chemicals and other products.

The company’s debt-to-equity ratio is zero and its total debt is also zero. The company is a small-cap stock with a capitalization of 1,126 crores. Its shares were settled at Rs. 158.75 each.

The share price of the company has increased by 16.38 percent in the last year.

You May Also Like: How to Learn Trading-Avoid 5 Mistakes

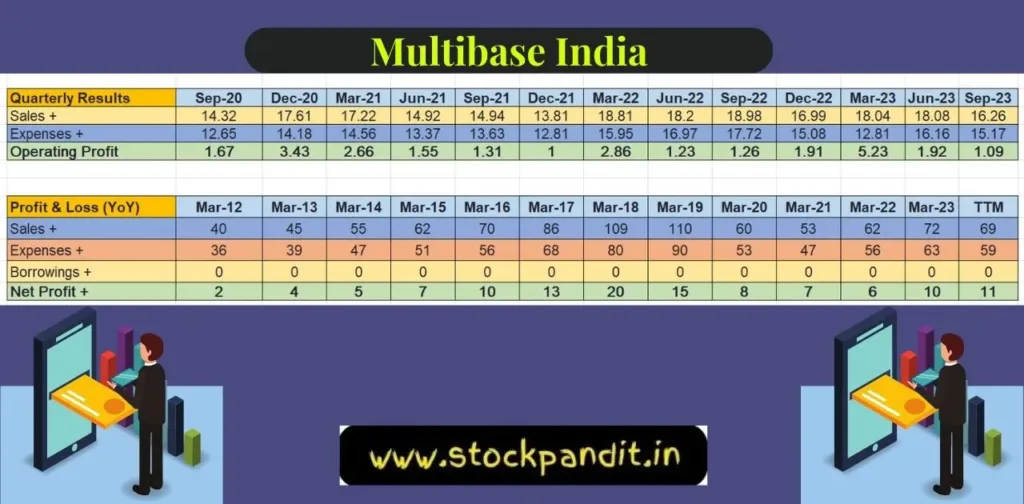

Fundamental of Multibase India

Multibase India manufactures, trades and sells thermoplastic elastomers as well as silicone-based products.

The company’s debt-to equity ratio is zero and its total debt is also zero. The company is a microcap with a market cap of Rs 305 Crores. Its shares were settled at Rs 238.15 each. The share price of the company has increased by 25.74 percent in the last year.

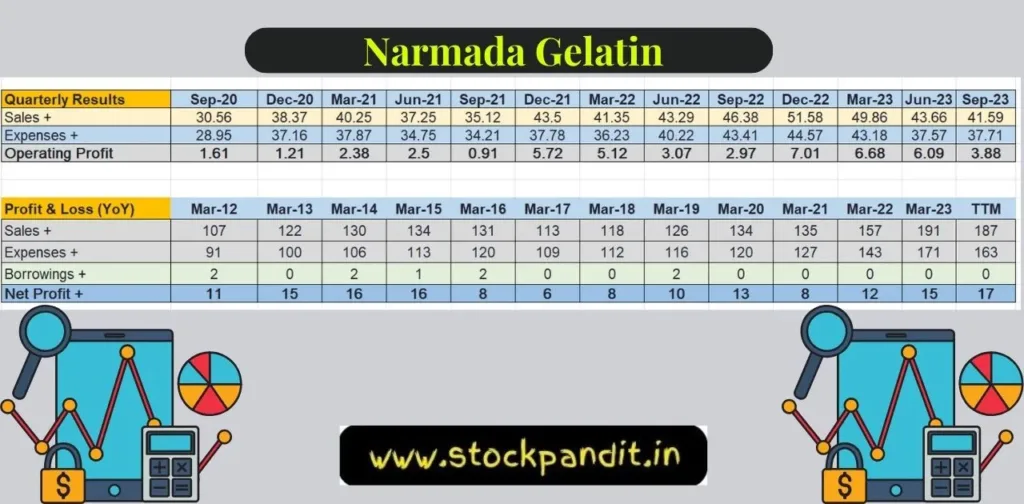

Narmada Gelatin

Narmada Gelatines Ltd. is engaged in manufacturing and selling Ossein and Gelatine.

The company’s debt-to-equity ratio is zero and its total debt is also zero. The company is a microcap with a market cap of Rs 267 Crores.

Its shares were settled at Rs 435.00 each. The share price of the company has increased 90.39 percent in the last year.

You May Also Like: How to Invest in Nifty 50 ETF 2024

FAQs:

What is the role of Foseco India ?

Foseco India Limited, a company based in India, is engaged in manufacturing of foundry chemicals and fluxes. The Company is engaged in the manufacture and trading of metallurgical goods and services.

What is the history behind Foseco ?

Foseco India Ltd.

Foseco India, originally called (Greaves Foseco), was advertised on March 22, 1958, as a joint venture between Greaves (a Thapar Group company) and Foundry Services Holdings (now Foseco), an Burmah Castrol Firm . The Thapars sold their stake to Foseco in November 1993, giving the company its current name.

What are the consumables used in foundries ?

We offer a variety of Foundry Consumables to meet the needs of different molding processes. We have formulated compounds and agents for every process, including cleaning molds, reducing adhesive forces in moulds, pre-treatment components, and covering and refining of alloys.

Tanfac Industries: What is it ?

Tanfac manufactures of Anhydrous Hydrofluoric Acid, Sulphuric acid, Oleum. Aluminium Fluoride (Ketafluoride), Potassium Fluoride (Ketafluoride), Boron Trifluoride Complexes (Boron Trifluoride), Calcium Sulphate, IsoButyl Acetophenone and Peracetic Acid.

Is Tanfac Industries a good buy ?

Is the Tanfac Industries Ltd. profitable? Yes, TTM profit after tax of Tanfac Industries Ltd.

What is the intrinsic worth of Tanfac Industries ?

Tanfac Industries Ltd’s (506854.BO), Intrinsic value as of 2023-12-21 is 1,366.73 Indian rupee. This 506854.BO value is based on Discounted cash flows (Growth exit 5Y).

Tanfac Industries Ltd’s upside is -43.8% at the current market price (2,429.95 INR).

Tanfac Industries: Who owns it ?

Tanfac Industries Ltd. is a joint-sector company promoted by Anupam Rasayan India Limited (r) and Tamil Nadu Industrial Development Corporation. The manufacturing facilities cover 60 acres of the SIPCOT Industrial Estate in Cuddalore.

What is the history behind Tanfac Industries ?

TANFAC Industries Limited is a joint venture company promoted by Anupam Rasayan India Limited. (Formerly Aditya Birla Group), and the Tamil Nadu Industrial Development Corporation Limited. Incorporated as in 1972, it is India’s largest supplier of fluorine chemical. The Company began production in March.

What is the credit rating of Tanfac?

Received an A1+ credit rating by Investor guidance body ICRA.

Tanfac Industries is a part of which sector ?

Chemicals industry:

Tanfac Industries Ltd. was incorporated in 1972 and is a small cap company (with a market capitalization of Rs 2,488.66 crores) that operates in the Chemicals sector.

Tanfac Industries Ltd.’s key products/revenue segments include Chemicals (other operating revenue), Scrap, and Export Incentives.

What is Uniphos Enterprises ?

Uniphos Enterprises Ltd (formerly United Phosphorus Ltd[UPL]), founded in 1969, was established to manufacture red-phosphorus as an import substitute. Erstwhile UPL began manufacturing several specialty chemicals such as compounds of phosphorus and pesticides.

What are the basic principles of a business ?

Fundamentals are important for businesses. Profitability, Revenue, Assets, Liabilities, and Growth Potential are all considered. You can calculate the financial ratios of a company to determine its investment feasibility using fundamental analysis.

What is the history behind Uniphos Enterprises ?

Uniphos Enterprises Ltd (formerly United Phosphorus Ltd[UPL]), was established in 1969 for the manufacture of red phosphorus as an import substitute. Erstwhile UPL began manufacturing several specialty chemicals such as compounds of phosphorus and pesticides.

What was the old name for Multibase India Ltd before ?

Synergy Polymers Ltd.

Multibase India Ltd, a company based in India was founded in 1991 under the name Synergy Polymers Ltd. Synergy Mulitibase Ltd was the name given to the company in 1999.

What is the history behind Narmada gelatines ?

Leiner-Knit Gelatin Company, Pvt. Ltd. Shah Wallace & Company acquired the Original Promoters P Leiner & Sons in 1978. In 1979, the company was renamed Shaw Wallace Gelatines Limited. The name was then changed again in 2002 to Narmada Gelatines Limited.

Who owns Narmada gelatines and Narmada gelatines ?

Directors of Narmada Gelatines Limited include Annamalai Sankaralingam Ashok Kumar Kapur Sankaralingam Maheswaran Kailasam Knamoorthy Balasubramanian Vjayadurai. Narmada Gelatines Limited’s Corporate Identification Number is (CIN) L24111MP1961PLC016023 and its registration number is 16023.

What is the purpose of Narmada Gelatin ?

Gelatine is produced by the company for a variety of purposes, including pharmaceutical. Edible. Industrial.

What are the products of Narmada Agrobase Ltd ?

Bleached Cotton Linters.

Maize Oil Cake.

Cattle Feed (Mesh)

Compound Cattle Feed (Pellet)

Delinted Cottonseed.

Disclaimer:

The risk of losing money when investing in stocks is high. Investors should exercise caution when investing in or trading stocks.

Stockpandit.in is not responsible for any losses incurred as a result from the decisions made based on this post. Consult your investment advisor prior to investing.